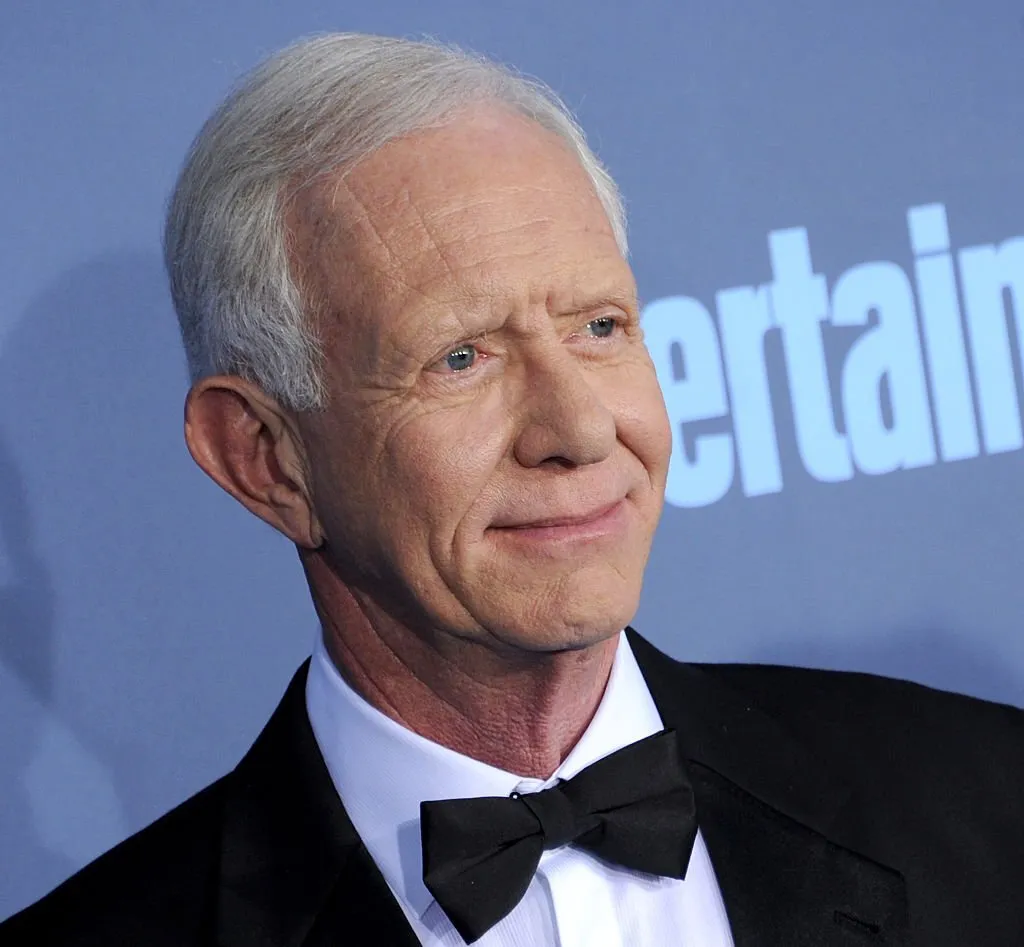

Discover Why Did Sully Lose His Pension in this comprehensive article. Uncover the facts, reasons, and insights behind this unfortunate situation.

In today’s article, we will delve into the intriguing question: “Why did Sully lose his pension?” Sully’s case has generated quite a few hobbies and curiosity, and we propose to provide you with a detailed account of the occasions and elements that caused these unlucky final results.

Introduction

Losing a pension is a distressing state of affairs that can have a profound effect on a character’s life. In the case of Sully, the reasons at the back of this loss are complex and multifaceted. This article will explore the key aspects of Sully’s pension loss, shedding light on the circumstances, decisions, and consequences involved.

| Question | Answer |

|---|---|

| Why did Sully lose his pension? | Sully did not lose his pension in the traditional sense. However, when US Airways went bankrupt in 2009, its pension liabilities were assumed by the Pension Benefit Guaranty Corporation (PBGC). The PBGC is a federal agency that guarantees the pensions of retirees from companies that have filed for bankruptcy. However, the PBGC only guarantees a portion of each pension, and the amount guaranteed is typically less than the full amount of the pension. As a result, Sully’s pension was reduced when US Airways went bankrupt. |

Understanding Sully’s Pension Loss

The Background

Sully’s pension loss did not happen overnight. To comprehend the situation fully, we must first understand the background and context.

Sully’s Career

Sully had a long and successful career in a reputable company. His dedication and hard work earned him a substantial pension, which he had been looking forward to enjoying during his retirement.

Financial Mismanagement

One of the primary reasons behind Sully’s pension loss was financial mismanagement. The company responsible for managing his pension fund made ill-advised investments that resulted in significant losses.

Legal Challenges

Sully also faced legal challenges related to his pension. There were disputes over the terms of his pension agreement, which led to prolonged legal battles.

Economic Downturn

The timing of Sully’s pension loss was unfortunate, as it coincided with a severe economic downturn. This economic crisis further eroded the value of his pension fund.

Poor Investment Decisions

Another factor contributing to Sully’s pension loss was poor investment decisions made by the fund managers. These decisions resulted in a substantial decrease in the fund’s value.

Lack of Diversification

Diversification is a crucial aspect of managing investment portfolios. Unfortunately, Sully’s pension fund lacked diversification, making it vulnerable to market fluctuations.

Regulatory Changes

Changes in financial regulations also played a role in Sully’s pension woes. New regulations had an adverse impact on the management of pension funds.

Lengthy Legal Battles

Sully’s legal battles to reclaim his pension were long and draining. The legal fees and stress took a toll on his finances and well-being. Click to read Scary Facts About Lake of the Ozarks.

Emotional Toll

Losing his pension had a severe emotional toll on Sully. The stress and anxiety affected his overall health and quality of life.

Final Words

In Final Words, Sully’s pension loss was a result of various factors, including financial mismanagement, legal disputes, economic downturn, poor investment decisions, and regulatory changes. This unfortunate situation serves as a reminder of the importance of careful financial planning and diversification in safeguarding one’s retirement funds. Sully’s story is a cautionary tale that underscores the need for vigilance and informed decision-making in matters of personal finance.